National Real Estate News

Mission Impausible?

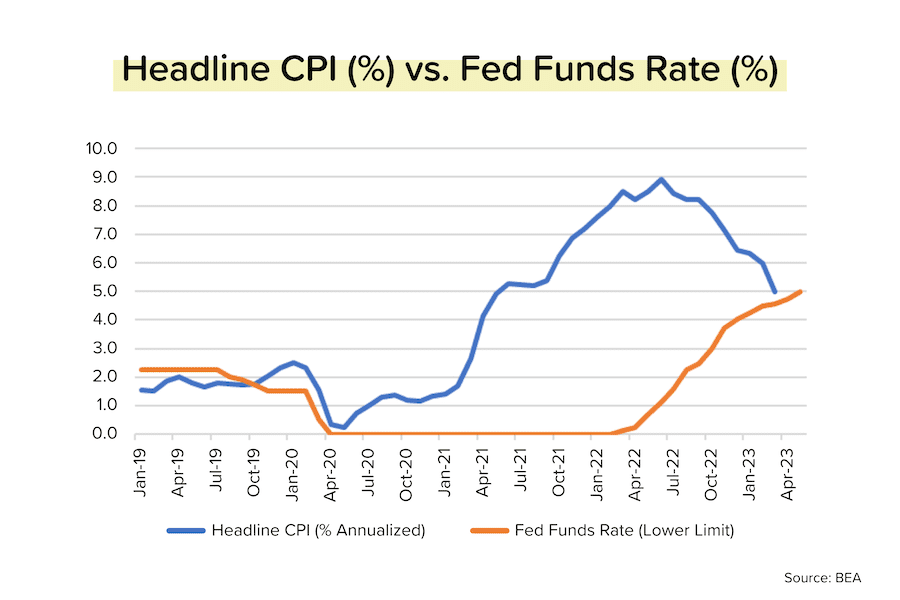

On Wednesday, the Fed raised short-term interest rates by another +25 bps (that’s one-quarter of one percent). That means that the Fed has lifted rates 10 times in 14 months for a total of +500 bps (5%)! Meanwhile, inflation has fallen dramatically (CPI from 9% –> 5%) and will continue to drop. And that means lower mortgage rates ahead – especially if the economy begins to contract.

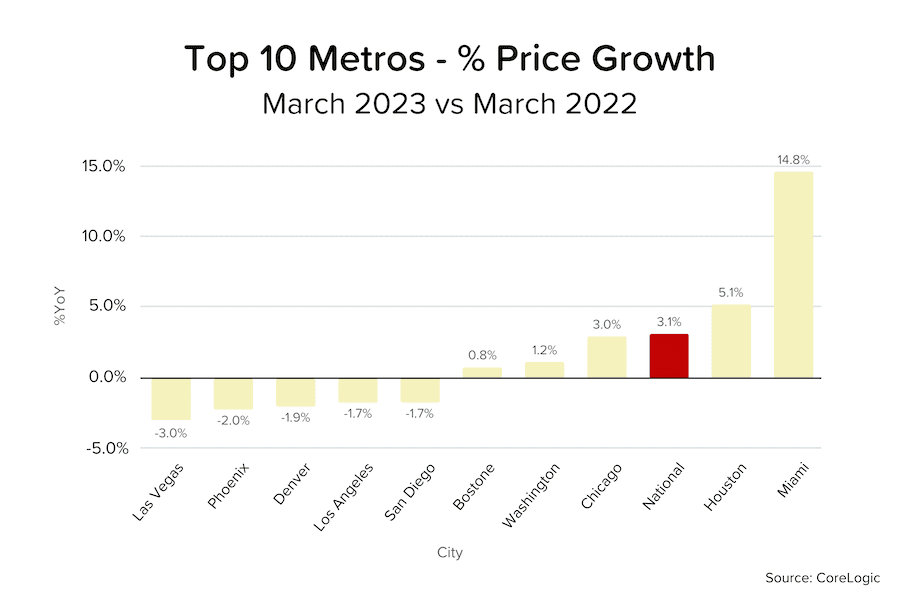

Prices bouncing

According to data provider CoreLogic, national home prices rose for the 2nd-straight month in March (+1.6% month-over-month). The price declines we’ve seen in some big cities since June 2022 are slowing or even reversing. With the inventory of homes so low, even a modest decrease in mortgage rates would drive demand (and prices) higher. CoreLogic sees home prices rising 4.6% over the next year.

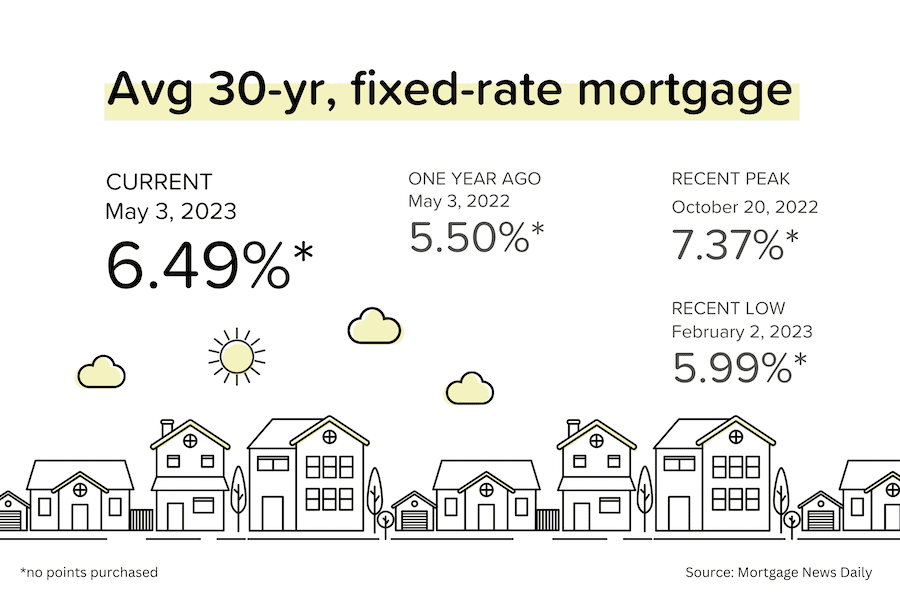

Back below 6.5%

Fed Chairman Jerome Powell couldn’t bring himself to say ‘pause’ (stop raising rates), but with inflation easing, banks going bankrupt and recession fears rising, it’s very likely that this rate hike cycle is over. That’s why average 30-yr mortgage rates are back below 6.5%. We’ve been here before and seen homebuying demand jump. We just need more homes to sell!

Local Market Trends

As of Friday, May 5, 2023

| Area | Median Price | Active Listings | New Listings – 5 days | Median Days on Market |

|---|---|---|---|---|

| Jessup, MD | $749,990 | 17 | 3 | 15 |

| Glen Burnie, MD | $425,000 | 61 | 17 | 24 |

| Middle River, MD | $394,950 | 36 | 3 | 38 |

| Severna Park, MD | $50,000 | 68 | 4 | 118 |